The Florida First Blog

First Choice Repair Network® Supports More Than Claims

Your Deductible, Your Budget, Your Choice

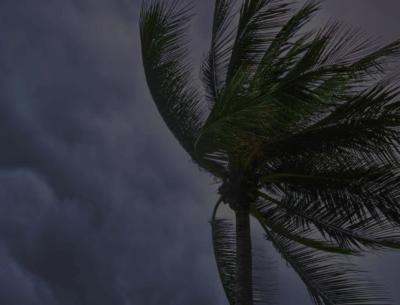

Hurricane Warnings and Your Insurance – Part 2

Hurricane Warnings and Your Insurance – Part 1

Florida Sinkholes: What Homeowners Need to Know

Roof Age vs. Roof Warranty

How to Manage Rising Homeowners Insurance Costs in Florida

Help Your Home—and Wallet—Stand Up to High Winds

Finding Insurance in Florida

What’s the Point of a 4-Point Inspection?

Florida Homeowners Insurance Hurricane Season | PSL Protection