News

Security First Insurance Expands Dwelling Fire Coverage and Reduces Rates 16% for Florida Landlords

How to Protect Pets and Plants During a Freeze

Security First Latest Florida Insurer to Roll Back HO3 Rates

Security First Insurance Announces 5.2% Statewide Rate Decrease on Signature+ HO3 Product

Security First Insurance sponsors children through Easterseals for the holidays

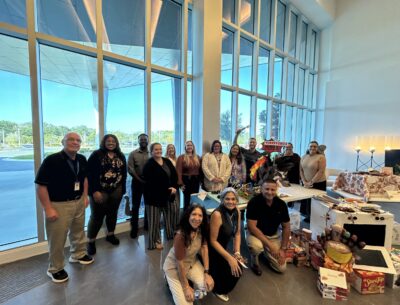

Security First Insurance Continues Tradition of Sponsoring Children through Easterseals

Security First helps feed families through Giving Thanks decorating contest

Security First CAREs: Feeding Local Families & Supporting Community Causes in 2025

Security First the Latest in Florida to Announce Home Insurance Rate Cut

Security First Insurance Announces Second Consecutive Year of Rate Decreases

Creative Tips from Security First Insurance to Help You Prepare for Storm Season