Safeguard Your Florida Lifestyle with Our Coverage

Our Coverage Options

Optional Add-Ons

- Scheduled Personal Property

- Identity Theft Protection & Monitoring

- Golf Cart Physical Damage and Liability

- Hurricane Screened Enclosures & Carport

- Dog Liability

What it Means to be #1

Our dedication to being Florida’s preferred homeowners insurance company means we offer more than just basic coverage. Our policies include additional features such as wind mitigation discounts, equipment breakdown coverage, and identity theft protection. By partnering with our in-house First Choice Repair Network, we ensure timely and efficient repairs when you need them the most. Explore our range of homeowners insurance options today and discover why Security First Insurance is ranked #1 for hurricane protection in Florida. Get a quote now and experience the unparalleled service and security that comes with choosing a trusted, local provider.

At Security First Insurance, we understand the unique challenges Florida homeowners face. Our comprehensive homeowners insurance policies are designed to provide robust protection against the unpredictable weather and natural disasters that are common in the Sunshine State. From hurricanes to tropical storms, our coverage ensures that your home and belongings are safeguarded. With flexible options tailored to meet your specific needs, we offer peace of mind knowing that your property is secure. Whether you’re a first-time homeowner or a seasoned resident, our Florida homeowners insurance plans are built to provide stability and financial strength, keeping you protected year after year.

Kudos From Our Customers

“An insurance company that actually cares about its customers. A true unicorn in the insurance industry. After hurricane Matthew, while other insurance companies were praying their phone’s didn’t ring, Security First was calling every single customer in the affected area and asking if they can help. True compassion.”

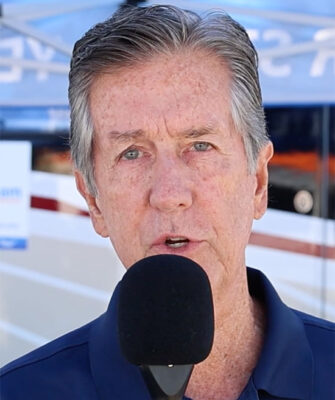

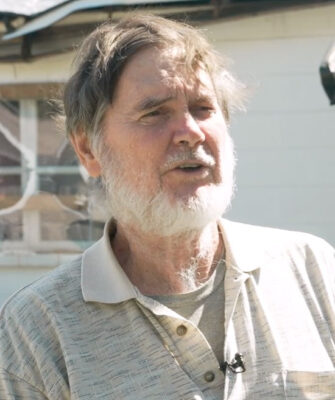

– Kenneth from Port Orange Florida

It’s so encouraging to see those that care about their customers and their clients here, trying to help them get a claim started and get their lives back in order.

I’ve been with Security First for about 10 years. I’m very happy with how the process is moving forward.

By that morning, I already had my claims number, they were already working on people to send out to take care of the tree, tarping the house, and getting an inspector … It’s been a real dream to work with them.

I wouldn’t use anyone else, honestly. It’s been a life-changing experience in terms of insurance.

They contacted us before the storm and after the storm to make sure that we were ok and had a place to go. We’ve recommended them to other people.

I can’t say enough about Security First Insurance. We have friends and family with other companies, and I don’t think they’ve had what we’ve had through every storm, and that means the world.

This is our third hurricane in 13 months, and Security First Insurance has been our homeowner’s insurance through all of them. I’ve had a really good experience.

I have the best insurance company in the state. I know I do. Security First has been a delight to work with. They’re simply the best.

I barely even have time to think about it, and I’m getting another contact from Security First about the next step in the process.

Security First has always come through. There’s security in Security First.

You hear a lot of nightmares with insurance companies, but this was not one of them. Thank you Security First.

I was shocked how quickly Security First reached out. So very happy we picked Security First for our home insurance.

Compare Our Plans

Choosing the right coverage can be overwhelming with so many options available. Use the chart below to compare our most popular policies and find the one that fits your needs.

- Premier (HO5)

- Dwelling Basic (DF1)

- Condo (HO6)

- Dwelling Landlord (DF3-DL)

† Two-night minimum required (HO6, DF1)

† Two-night minimum required (HO6, DF1)

‡ Four-night minimum required (DF3-DL)

- Premier (HO5)

- Dwelling Basic (DF1)

- Condo (HO6)

- Dwelling Landlord (DF3-DL)

† Two-night minimum required (HO6, DF1)

† Two-night minimum required (HO6, DF1)

‡ Four-night minimum required (DF3-DL)

Resources For Homeowners

Homeowner Tips

Homeowner Tips

The 3 P’s of a Florida Freeze

Florida winter freeze prep made simple: protect pets, plants, and pipes with smart, homeowner-friendly tips for cold snaps.

Homeowner Tips

Homeowner Tips

6 Easy Florida Winter Home Fixes Than Can Prevent Costly Claims

Florida doesn’t get snow—but winter is still your best chance to prevent leaks, mold, and insurance headaches. Here’s a quick home check every homeowner should do now.

Home Improvement

Home Improvement

First Choice Repair Network® Supports More Than Claims

Discover how Security First Insurance’s First Choice Repair Network® helps Florida homeowners with trusted contractors for repairs, renovations, and faster claims.

Florida Lifestyle

Florida Lifestyle

Roof Age vs. Roof Warranty

A “30 year roof” is a manufacture’s marketing term, not an insurance guarantee. Discover why roof age, not roof warranty really matters for your Florida home.