Signature+ Insurance

An Insurance Product with a Disappearing Deductible!

Introducing

Signature+ (HO3) Insurance

Welcome to the future of homeowners insurance with our new Signature+ (HO3) Policy! This innovative offering is designed to provide you with the best discounts and deductibles, including a Disappearing Deductible that rewards you for being claims-free.

This coverage is available now! If you are currently on our legacy Signature (HO3) Policy, please speak with your Agent to get a quote for this new product and determine if it is a better fit for you.

Competitive Rates

With increased statewide coverage, we can now offer you a more competitive rate.

Disappearing Deductible

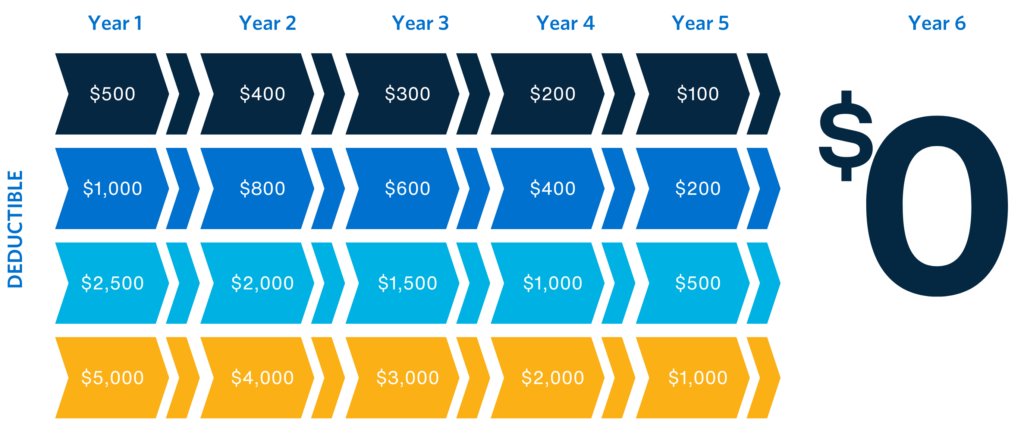

The Disappearing Deductible endorsement rewards you by reducing your AOP and Water deductibles by 20% each year.

More Discounts Available

We now have discounts for: Military/First Responder, Multi-Policy, and Smoke Detectors.

Flexible Coverage Options

We’ve got you covered, Florida! You have options when it comes to water and content coverage. Choose what fits your needs!

Our Signature+ (HO3) Policy Includes

Our Signature+ (HO3) policy offers extensive coverage at a competitive price for Florida homeowners. It includes benefits like coverage for personal property loss, a Disappearing Deductible endorsement, and a variety of discounts.

HO3 Coverage for the

Structure of Your Home

Coverage A provides coverage for your home. Your Coverage A limit should reflect the amount to rebuild your home. This is known as your home’s replacement cost value, which is not the same as the market value of your home. How do you determine the replacement value of your home? We have a tool called a replacement cost calculator that you can utilize to help you and your agent determine the replacement value of your home.

In our Signature+ (HO3) policy we offer Coverage A limits from $200,000 to $5,000,000.

(a higher minimum coverage limit applies to properties located in certain counties)

HO3 Coverage for

Other Structures

Coverage B provides coverage for other structures located on your property that aren’t attached to your home. An unattached garage, barn, utility shed, or in-ground swimming pool would be considered an “other structure”.

In our Signature+ (HO3) policy we offer Coverage B limits from 2% to 70% of the Coverage A limit.

Tip: if you have an inground pool with an attached aluminum screened enclosure you may want to consider adding our optional Limited Screened Enclosure or Carport Coverage endorsement.

HO3 Coverage for

Your Contents

Coverage C provides coverage for your personal property. Furniture, clothing, jewelry, electronics, and appliances are a few examples of personal property items you may want to insure.

In our Signature+ (HO3) policy, we offer Coverage C limits between 5% and 75% of the Coverage A limit.

You also have the option to exclude this coverage.

HO3 Coverage if

Your Home is Uninhabitable

Coverage D provides coverage for the additional living expenses you and your family incur when your home becomes uninhabitable due to a covered loss. This includes the cost of a place to stay, food, and clothing.

The Signature+ (HO3) policy provides a Coverage D limit of 10% of the Coverage A limit.

To ensure our customers have immediate access to the funds they need, we provide them with a pre-paid debit card. This is one of the many solutions we’ve implemented to improve our customers’ experience.

Tip: It’s important to keep all your receipts.

HO3 Coverage for

Personal Liability on Your Property

Coverage E provides coverage that can protect you in situations that may be unforeseen, such as a friend twisting their ankle on a loose step. Liability coverage also covers certain defense costs – even if the lawsuit filed against you is false, groundless, or fraudulent. However, it does not cover liability losses caused by any animals you own or keep.

The Signature+ (HO3) policy offers Coverage E limits of $100,000, $200,000, $300,000 and $500,000.

If you’re a dog owner, we have an optional Dog Liability Coverage Endorsement that can be added to your policy to provide coverage for bodily injury and property damage caused by your dog (certain restrictions apply).

HO3 Coverage for

Your Medical Payments

Coverage F provides coverage for medical expenses incurred by someone who does not reside in your household and is injured on or by your property.

The Signature+ (HO3) policy offers Coverage F limits of $1,000, $2,500, and $5,000.

Optional Add-Ons

- Scheduled Personal Property

- Identity Theft Protection & Monitoring

- Golf Cart Physical Damage and Liability

- Hurricane Screened Enclosures & Carport

- Dog Liability

Signature+ (HO3)

Disappearing Deductible

The Disappearing Deductible endorsement rewards you by reducing your AOP (All Other Perils) and Water deductibles by 20% each year. This automatic endorsement applies to AOP and Water deductibles only and does not affect the Hurricane Deductible.

Compare Our Plans

Choosing the right coverage can be overwhelming with so many options available. Use the chart below to compare our most popular policies and find the one that fits your needs.

- Signature+ (HO3)

- Premier (HO5)

- Condo (HO6)

- Dwelling Landlord (DF3-DL)

- Dwelling Owner (DF3-DO)

† Two-night minimum required (HO6, DF1)

‡ Four-night minimum required (DF3-DL)

‡ Four-night minimum required (DF3-DL)

- Signature+ (HO3)

- Premier (HO5)

- Condo (HO6)

- Dwelling Landlord (DF3-DL)

- Dwelling Owner (DF3-DO)

† Two-night minimum required (HO6, DF1)

‡ Four-night minimum required (DF3-DL)

‡ Four-night minimum required (DF3-DL)

Additional Coverage Options

Our flexible coverage options, knowledgeable agents, and exceptional customer service ensure that you have the right coverage for your specific needs.

Premier Homeowners Insurance

Dwelling Basic

Condo Insurance

Dwelling Flex

Landlord Flex

Renters Insurance

Protect Your Home Today

We stand behind every policy we write, storm after storm, year after year®.

Our simple and convenient quote process makes it easy for you to get started. Take the first step towards protecting your most valuable asset by requesting a quote today.