Beware of Assignment of Benefits

Maintain control of your home insurance claim; assigning benefits to a home repair vendor could be costly.

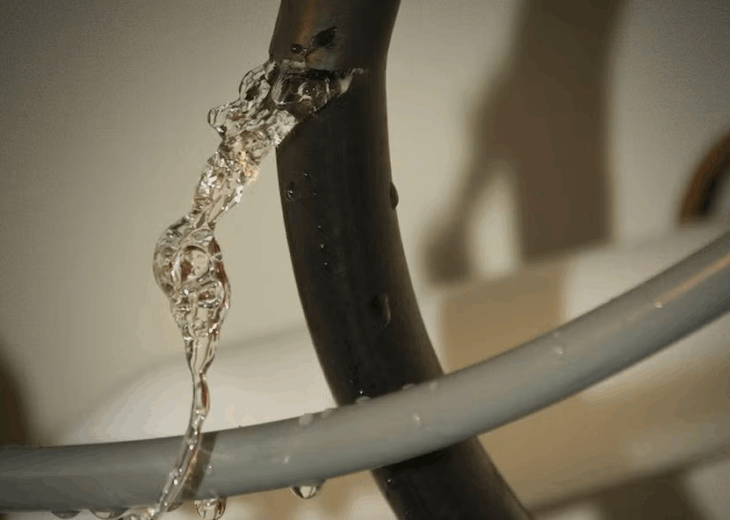

You come home after a hard day’s work to find a small river flowing through your kitchen – the result of a plumbing leak.

Which of the following is the ideal way to handle this problem?

A. Wait for Mr. Clean to show up and make everything all better

B. Use your smartphone to search for water extraction contractors, and ask the first contractor who answers your call to come clean up the mess pronto!

C. Call the water extraction contractor that your plumber recommends.

D. Contact your insurance company to report the loss so they can refer a licensed, experienced, and reputable water extraction contractor to dry out your home.

Unless you have a fairy godmother or magic wand, option A probably isn’t a viable solution for you to consider in this situation. Option D is actually the best first step to take if you have water damage in your home. Unfortunately, many Florida home insurance customers choose options B or C – a decision that can have costly consequences.

It’s natural to want to expedite the recovery process, which is why a water extraction contractor is often the first person a homeowner calls after experiencing water damage in their home. Recognizing the stress and urgency of the situation, some water extraction contractors require customers to sign an “Assignment of Benefits” (AOB) clause or form before agreeing to begin work. Other contractors may recommend that customers sign the AOB form to avoid the “hassle” of dealing with their insurance company.

An AOB is a clause that, once signed, transfers control of the claim from the customer to the contractor – allowing the contractor to collect any payments directly from the customer’s insurance company. By assigning your benefits (claims proceeds) to your contractor, you’ve just signed over all rights to your claim. The contractor is now in total control of reporting the amount of loss to your insurance company and negotiating the payment. You, the homeowner, are no longer in control of your insurance claim.

Now that your contractor is in control, he can bill your insurance company for work he hasn’t done, overcharge your insurer, or simply take your proceeds and never even begin working on your home. Either way, you can on the hook to pay for your contractor’s scams.

If the inflated bill exceeds what is covered by your homeowners insurance policy, you’re on the hook to pay the difference. The contractor could place a lien on the home, and contractor liens in Florida can be enforced by foreclosure. This type of fraud, while extremely costly to individual homeowners who’ve fallen victim to the scam, affects all Florida homeowners. Fraud is currently one of the primary drivers of home insurance premium costs. AOB fraud is far from a victimless crime!

First things first: contact your insurance company FIRST in the event of a loss. Not only will this help you avoid dealing with an AOB issue, but, thanks to the partnerships most insurance companies have with reputable water restoration companies, your insurer can probably get a technician to your home quicker than you can if you make the call!

Consider the following suggestions to help you avoid AOB scams:

Once your home is dry and you’re ready to make repairs, what should you do?

Florida Lifestyle

Florida Lifestyle

Explore 7 Florida homeowners insurance products tailored to your needs—from condos to rentals to high-value homes. Get a quote today.

Home Improvement

Home Improvement

Discover how Security First Insurance’s First Choice Repair Network® helps Florida homeowners with trusted contractors for repairs, renovations, and faster claims.

Homeowners Insurance Florida

Homeowners Insurance Florida

Learn how to choose your homeowners insurance deductible. Compare flat vs. percentage options, see real examples, and decide what’s best.